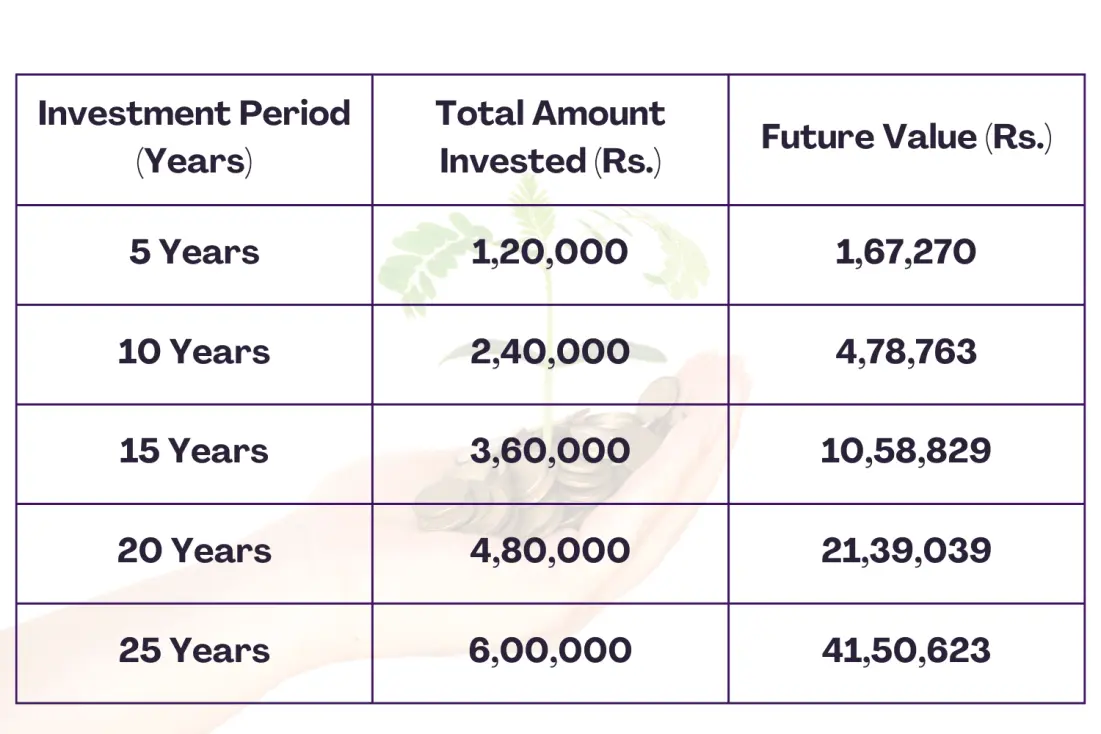

Your Money Tree: SIP Growth Calculator

Here is a table showing the estimated mutual fund investment growth for SIP of Rs. 2000 with 12.5% CAGR for different time periods:

Assumptions:

SIP of Rs. 2000 per month

12.5% Compounded Annual Growth Rate (CAGR)

Compounding frequency:

Monthly

No withdrawals or fees

Note: The estimated values are calculated using the formula for compound interest and may vary depending on the actual performance of the mutual fund.

This table clearly illustrates how the invested amount grows significantly over time due to the power of compounding.

Join Our Financial Adventure!