The Power of Early Investing

Assumptions:

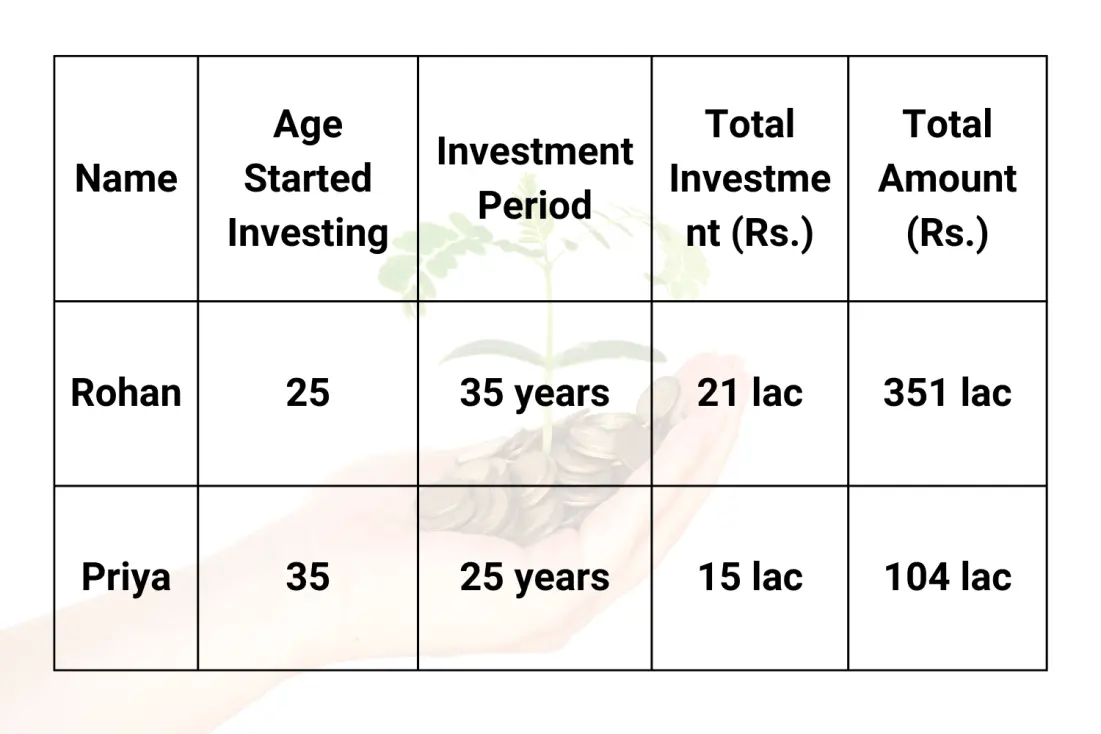

Monthly SIP of Rs. 5,000

Expected annual return of 12%

Understanding the Table

Age Started Investing: The age at which the individual begins investing through SIP.

Investment Period: The number of years the individual continues investing.

Total Investment: The total amount invested over the investment period.

Total Amount: The estimated value of the investment at the end of the investment period.

Key Takeaways:

1) Starting to invest early provides a significant advantage due to the power of compounding.

2) The earlier you start, the more time your money has to grow.

3) Even a small difference in the starting age can lead to a substantial difference in the final corpus.

Join Our Financial Adventure!